The velocity of money is a function of interest rates and inflation rates. As interest rates go up, the velocity of money will go up. Originally the Fed claimed they had an exit strategy to reduce the money supply and prevent inflation. However, they no longer seem to have a strategy for reducing the money supply. The money supply is still going up, not down. With an increasing velocity of money and increasing money supply, the equation of exchange predicts inflation will go up. Since inflation also increases the velocity of money, and so further pushes up inflation, the risk of "run-away-inflation" is real. Since few other people expect this, most people will be surprised. Now that interest rates have started going up, we should expect surprising inflation.

At least that is what my theory predicts. It will be interesting to watch the experiment unfold and the results come in.

Hyperinflation is that transition period when a paper money is clearly failing as a store of value but has not yet died as a medium of exchange. This blog is to look at this and any other interesting economic issues. Vincent Cate

Sunday, December 20, 2015

Tuesday, December 8, 2015

How Dynamic Hedging Will Fail

I expect dynamic hedging strategies to fail badly sometime in the next couple years.

There are companies that sell options and use dynamic hedging. This means they make frequent adjustments to their overall position so that on net it remains neutral for small movements in the market. They have to keep adjusting their position all the time in order to sort of be hedged. For example, if they sell some calls on a stock and just the right number of puts on the same stock then for small changes of the stock in either direction the gains and losses on the puts and calls can compensate each other. But after the stock moves a bit it will take a different number of puts and calls to balance each other, so they must either change the quantity of puts/calls they hold or buy/sell some of the stock so that once again they are net neutral for small changes in the stock.

It is not a true hedge though. In the event of a crash, they can not adjust their position fast enough and so they are not net neutral during the crash. In the call/put example above, the calls become nearly worthless and the puts very valuable. What they lose by being short the puts is far more than the gain being short the calls. As they try to adjust their positions, say by shorting the stock as it goes down, they will contribute to the crash. In a crash, companies using dynamic hedging could go bust.

It is kind of similar to the portfolio insurance that people were doing around the time of the 1987 crash. It all looks ok on computer simulations which assume nice continuous pricing changes and that their buying and selling does not change the price much. However, after an investment idea is popular, large numbers of people doing the same thing means things do not work like they did in the computer simulation. The people using the idea can drive the price and the price can move so fast that the idea can not be implemented as planned. So the very activity of "portfolio insurance" or "dynamic hedging" done by many people can cause a crash. When the hedging algorithm fails, companies based on it will go bust.

A company selling a put on the S&P but using dynamic hedging is like a company selling insurance against a crash while not really being in a position to pay off on the policy in the event of a crash. If too many companies selling such options go under, it could be very messy.

Murphy's Law says that anything that can fail will eventually fail. Dynamic hedging can fail.

There are companies that sell options and use dynamic hedging. This means they make frequent adjustments to their overall position so that on net it remains neutral for small movements in the market. They have to keep adjusting their position all the time in order to sort of be hedged. For example, if they sell some calls on a stock and just the right number of puts on the same stock then for small changes of the stock in either direction the gains and losses on the puts and calls can compensate each other. But after the stock moves a bit it will take a different number of puts and calls to balance each other, so they must either change the quantity of puts/calls they hold or buy/sell some of the stock so that once again they are net neutral for small changes in the stock.

It is not a true hedge though. In the event of a crash, they can not adjust their position fast enough and so they are not net neutral during the crash. In the call/put example above, the calls become nearly worthless and the puts very valuable. What they lose by being short the puts is far more than the gain being short the calls. As they try to adjust their positions, say by shorting the stock as it goes down, they will contribute to the crash. In a crash, companies using dynamic hedging could go bust.

It is kind of similar to the portfolio insurance that people were doing around the time of the 1987 crash. It all looks ok on computer simulations which assume nice continuous pricing changes and that their buying and selling does not change the price much. However, after an investment idea is popular, large numbers of people doing the same thing means things do not work like they did in the computer simulation. The people using the idea can drive the price and the price can move so fast that the idea can not be implemented as planned. So the very activity of "portfolio insurance" or "dynamic hedging" done by many people can cause a crash. When the hedging algorithm fails, companies based on it will go bust.

A company selling a put on the S&P but using dynamic hedging is like a company selling insurance against a crash while not really being in a position to pay off on the policy in the event of a crash. If too many companies selling such options go under, it could be very messy.

Murphy's Law says that anything that can fail will eventually fail. Dynamic hedging can fail.

Monday, November 23, 2015

Friday, September 18, 2015

Punchbowl Removal Difficulties

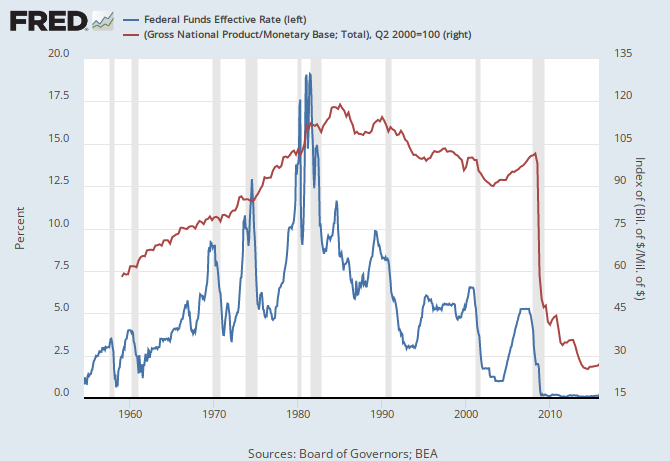

Using FRED Graph we can see the velocity of money goes up and down with the interest rate. This makes sense.

The Equation of Exchange says:

The Equation of Exchange says:

where:

= Money supply

= Money supply = Velocity of money

= Velocity of money = Price level

= Price level = Real GNP

= Real GNP

When you first introduce the punchbowl, as the Fed buys bonds or lends to banks cheaply the money supply goes up and the interest rates go down which makes the velocity of money also go down (as seen in the graph above). The lower velocity of money can largely compensate for the increased quantity of money so that the price level does not change too much. It seems like free money has no downside and the central bank has amazing powers.

- However, if you try to withdraw the punchbowl the interest rates also go up, increasing the velocity of money. This increased velocity of money compensates for the reduced money supply so you have the pain of higher interest rates but still get the inflation. It can seem like "inflation is out of control" and the central bank is powerless. This makes for a difficult time for a central bank. It can take a very strong leader and a recession to really get inflation under control.

However, the velocity of money can also go up because of inflation. So if they don't take the punchbowl away you can get inflation because of the increasing money supply and also from the increasing velocity of money. In bad cases this can develop a positive feedback loop and really get out of control.

- John Hussman has a graph showing how extreme the current conditions of low interest rates, high money supply, and low velocity of money are:

- Even a tiny move from 0.125% to 0.25% in the fed funds rate would imply a similar move in 3-month treasuries, which the above graph indicates will cause a large increase in the velocity of money. By the equation of exchange, a large increase in the velocity of money will increase the price level and inflation.

- Update: Jason Smith made a post responding to this one. There are interesting comments here and also on that post.

- Update 12/23/15: two more graphs:

- Graph with fed funds and velocity of monetary base:

-

- Graph with fed funds and velocity of monetary base less excess reserves. Better fit if we take out excess reserves. Lower interest rates lower velocity and higher raise velocity. Some lag though. I like this view of short term stuff better than Hussman's.

-

- Since I think excess reserves are really like government debt, and base money should be stuff that does not pay interest and so has a hot-potato effect, I think it is correct to subtract excess reserves from the base money when calculating velocity of money to compare to fed funds rate.

- Update 12/29/15:

- Tom Brown points out that all reserves earn interest and so are not really like interest free money. So I made another graph with all reserves subtracted:

-

Introducing the punchbowl is easy and removing it is difficult but keeping the punchbowl forever can be deadly.

Sunday, June 28, 2015

Euro with a "Y" is the new Drachma

When the Greek central bank prints Euros, they have a "Y" on them. Up till now these Greek Euros were exchanged 1 for 1 with any other Euros.

The Target2 system for electronic payments is how they kept all the different Euros values pegged to each other. However, if Greece no longer gets unlimited credit from the ECB the electronic Euros inside Greece can no longer be converted in unlimited amounts to Euros in other countries. The Greek Euros are sort of an island separate from other Euros. If Target2 does not work for Greece, then Greek Euros are no longer regular Euros.

The peg between Greek Euros and others is failing. No longer will Euros in Greek banks or Euros printed by the Greek central bank be as good. People will soon prefer to hold Euros with anything other than an "Y" or in banks outside Greece. Capital controls in Greece now limit how fast people can take Euros out of Greek banks, while the same ATM does not limit someone with an account in another country. Euros in Greek banks are not as good as Euros in banks in other countries. It could soon be that people outside Greece no longer accept Greek Euros. Where they are accepted, the Greek Euros could trade at a discount to other Euros. The worse things get the bigger the discount will become. Euros with an "Y" can become a separate special Greek only Euro, or effectively, Drachma.

As long as Greece was running a big deficit and on net getting more money each year from the Troika it made sense for it to do whatever was required of it. If Greece did not they would not have enough money to operate the government, since nobody else would loan them money. However, after getting to the point where they have a budget surplus and were going to be on net paying money to the Troika, they really can default and probably are better off to do so.

If a company could shed liabilities while still holding onto all its assets and sources of income, then it will be in a stronger financial position. Countries are similar when defaulting on external debts. Most of the time countries can default without any invasion or other real penalty. I don't expect Greece to be invaded because of their default.

When England and the USA defaulted on their promise to redeem their paper notes for gold the rest of the world was worse off and they were better off. It helped them get out of the Great Depression. In the short term Greece is no doubt in trouble, but in the longer term defaulting should remove a huge burden from their shoulders and leave their creditors worse off.

If Greek Euros are not equal to other Euros, it is as if "Greece has left the Euro". The market price for the Greek Euros will just be different than other Euros. This can happen fast without any deliberate action by any government. Maybe in the next few weeks.

We might see a "black market exchange" where a tourist coming into Greece could exchange their regular Euros for more local Euros. This could encourage tourism to Greece.

At some future point, when it is clear Greek Euros are no longer regular Euros, Greece could exchange Greek Euros for a newly issued Drachma.

If the Greek government keeps a nearly balanced budget the Greek Euros or Drachma should stabilize after an initial adjustment. If they start running big deficits in the near future, hyperinflation is a possibility.

We live in interesting times.

Update 7/4/15: An earlier version of this post said Euros with an "N" were from Greece. It seems this is the printer code and "Y" really means Greece. Thanks for commenter below pointing this out.

Wednesday, June 17, 2015

Inflation and the Louisiana Purchase

In 1803 the US paid $15 million for the Louisiana Purchase (white part in map below). Today this would be closer to $15 trillion. So maybe a factor of 1 million inflation.

By official inflation numbers this $15 million is $236 million in 2014 U.S. dollars. This is about a factor of 16 inflation.

Originally the dollar was defined as 1 oz of silver. Now silver is about $16 dollars/oz, or a factor of 16 inflation.

Gross public debt in 1800 was $83 million. Today gross public debt is $21.7 trillion. This is a factor of 261,000.

It is interesting that silver is only up by a factor of 16 and public debt is up by a factor of 261,000.

This reminds me of a movie where Dr Evil, who was frozen in the 1960s and then woken up in the present, threatens the world with nukes and demands "1 million dollars". In the early 1960s they still had real silver dollars in circulation.

Monday, June 15, 2015

Stages of Hyperinflation

There is a general pattern for the stages of hyperinflation. This can also be viewed as the stages of the "death of a fiat currency". Money can be seen as serving 3 roles. It is a medium of exchange, it is a store of value, and it is a unit of accounting. As we move through the stages of hyperinflation the money gradually gives up these 3 roles. Once it has given up all 3, it is dead.

- Government spending gets out of control to where deficit is 40% or more of spending and debt is over 80% of GNP. If this is for a war that the markets believe will be won and ended so that the government can make drastic cuts in spending then there is some wiggle room in these numbers.

- This goes on for a couple years and investors move towards shorter term bonds.

- It becomes clear the deficit is not going back down.

- The central bank starts buying up government debt with newly made money. If they are not naturally inclined to do this the government changes the laws or people running the central bank. For the rest of this section I will write as if the central bank were just part of the government and ignore bond certificates printed by the government and handed to the central bank as these will become worthless anyway. With this simplification I will just say, "the government prints money".

- There is capital flight out of that currency and bond sales fail. If the government let bond interest rates rise to attract bond buyers the interest payments on the debt would be huge compared to taxes collected, so they keep interest rates down by printing more money. However, the private investors become less and less inclined to "roll over" their government bonds.

- Government is forced to print money to cover their budget and inflation picks up. The more bonds coming due the worse the printing is. Many short term bonds can make for huge amounts of printing, even more than the regular budget.

- Some people notice prices going up and spend their money before prices go up more, even for things they don't need yet. The velocity of money picks up. People start to realize that the local currency is not a good store of value, though still used for transactions. Some people start to use foreign currencies or gold as a store of value.

- So many people take money out of their bank accounts and exchange it for a foreign currency, or gold, or just buy something that banks are in danger of going under. So the government often freezes bank accounts. This is very bad for the account holders, both because times are hard and they can't get their money and also because by the time they are able to get it their money it is worth much less.

- Wages and prices become indexed to something more stable, like a foreign currency or gold. So the local currency is losing the "unit of account" function. Wages become paid more often, like weekly or daily instead of monthly. The velocity of money picks up more.

- People start to use a foreign currency or gold as store of value, even though government may forbid it. The black market starts in currency exchange.

- Interest rates are very high and loans are for much shorter periods. Loans may be for a couple months instead of 30 years. Hyperinflation makes for hard times and many people are forced to sell their their land or house. Because of these things the real prices for things usually bought with long term loans can drop in terms of something like gold. Houses may usually be bought with a bag of some foreign currency. Real estate is very different during hyperinflation and normal times.

- People start to use barter or a foreign currency or gold for trade, even though government forbids it. This is a growing black market for commerce. If you trade a fish you caught for some potatoes your friend grew, neither of you is paying any taxes on the deal. In general once people are breaking the law by using a foreign currency for trade they don't pay any taxes on trade either. The black market is tax free.

- Being tax free and with better store of value the black market eventually grows larger than the legal market. People no longer worry about the government requirement to use local paper currency, enforcement is impossible.

- A business that follows the law and sells for regulated prices in the local currency can not buy enough new inventory and soon goes out of business. This makes the percentage of the economy that is black market go up.

- People start to not want to accept the local paper money. Regular taxes are down because hyperinflation has devastated the economy and much of the economy is now in the "black market". The government is finding it hard to buy things by printing money, as so much of the economy has moved to the black market. It is finding it hard to pay employees enough for them to live comfortably even though it keeps printing more all the time. The government is losing economic power. Tax collectors may be skipping work to tend to their own vegetable garden. There is a very real risk of the government failing at this step.

- At this point the government has some hard choices if it is not going to fail. It needs to do something so that the "black market" is legalized and taxable and deficits are nearly eliminated. It could just legalize a foreign currency or gold. But then it would forever give up on collecting any "inflation tax". It could get rid of budget deficits and stop printing money. However, people will still fear that it could start again at any time and so be hesitant to use that money. I think the most frequent end to hyperinflation is by making a new fiat money but with enough governmental changes that deficits and inflation are under control and people will use the new money. If they switch to a new currency then the old money is no longer used as a store of value, or unit of account, or even as a medium of exchange. It has died.

How to Prepare for Hyperinflation

If you understand hyperinflation and think your country is at risk, how should you prepare?

Bug-Out

If it is just the country you are in, leaving that country and going somewhere else is a reasonable strategy. However, I think that we could see all the reserve currencies get hyperinflation, the Yen, Euro, Pound, and the Dollar. Since the reserve currencies are the backing for the other currencies, if they go, then all paper money is in trouble. If a government had a balanced budget, the currency could just go down till it gets to where the total value of the currency is equal to the total value of the gold a central bank has. However, since governments run deficits, we should expect continued money printing and continued devaluation. There may not be anyplace that is immune from hyperinflation this time. In past hyperinflations, Bug-Out was a reasonable strategy, but it may not work this time.Security

Hyperinflation is not usually a Mad Max situation, but there usually is some increase in crime. So guns and general home security are more important. There are books and websites on this topic. There are many things you can do to improve home security. Good fences and gates, dogs, solid doors and windows, window bars, cameras, lights, alarms, etc. If hyperinflation becomes world wide, the security problem could be much worse than in a normal hyperinflation.Supplies of Food etc.

Governments usually put on price controls and make shortages of all sorts of things. It is simple micro-economics. If you have an artificial government legislated price, the supply does not equal demand. Because of this, having some stuff stored up ahead of time can make a huge different. Food and water are good things to have. Life is better with toilette paper, laundry soap, etc. Today you can probably afford to buy a "one year supply of food" and, if there is hyperinflation, it could be a lifesaver. It is easy now to buy a big tank, fill it with water, and put in a bit of bleach so it can last a long time. In the future, just getting water could be hard.If your currency is dropping fast, then you are better off buying extra canned goods than holding the currency. Eventually you will eat the food and by that time it would cost far more. After years of hyperinflation in Argentina, people built far larger pantries. It is good to be able to store a bunch of canned goods at home during hyperinflation. It is better than money in the bank.

Farming

Under government price controls, farmers can often not sell their food for enough to buy supplies for the next crop. It is often better for them and their family to just keep what food they grow, or only do direct trades for other food, labor, needed equipment, fuel, gold, etc. However, when the farmers don't bring their food to town to sell at artificially low prices, often the government, or the public and some police, will come and take the food. The real problem is the worthless money and price controls, but the government can easily redirect public anger toward the farmers. After the government passes a new law against "hording", it is easy to get people angry that while there is a shortage of food a farmer is "illegally hording food". Note that there are no laws against hording before price controls mess things up.Gold and Silver

Over time a hyperinflating currency is accepted less and less. Gold and silver hold their value and are accepted more and more over time. There is probably someone who would trade them for the local currency if you need local currency. If there is hyperinflation, by the time you trade in your gold you will get far more local currency than if you had just saved some currency instead of gold.Some people think things will be so bad that nobody would give up their food for gold that you can't eat. This is not correct. Trade still goes on, even if it has to be black market. In a French hyperinflation people kept trading for gold even when the penalty was losing your head. There will always be people who have more than enough of one thing and not enough of something else. Imagine one person grows potatoes and someone else who raises chickens, they both could be interested in trading. They may trade directly with each other or for gold and use gold to buy the other.

Bitcoin for Internet Purchases or Store of Value

Governments put on capital controls so money can no longer flow freely in and out of a country. They also put on official government exchange rates, which you won't be able to get in the direction you want. Because of this your credit card that used to be able to order anything on the Internet will no longer be able to buy things. A nice way around this problem is to use Bitcoin. You can use Bitcoin to buy things on the Internet even when their are capital controls stopping the normal methods for International payments. You could have to pay substantial taxes to get your order through customs, but they seem to usually allow things in or nobody will be ordering anything.As with gold and silver, where there is hyperinflation, there will probably be someone not too far away that is trading bitcoins to/from the local currency, even if it is against the law. So getting some Bitcoin ahead of time, or during the hyperinflation, could work well both for Internet purchases and as a store of value that you can convert back to local currency as needed.

Investment Options

If hyperinflation comes, bonds are the worst thing to hold. To get the present value of the bond, the future value is discounted by the projected inflation rate over the time till maturity. If there is high inflation and many years, the bond can be discounted to almost nothing. If in the first 6 months the currency is down 25%, a 20 year bond could be down by more than a factor of 1,000.Cash is not good to hold as it is dropping, though not nearly as fast as long term bonds. Governments may freeze bank accounts, so money in bank accounts could end up trapped for many months and worth far less by the time it can be taken out.

Stocks are not safe because governments usually make life very hard for companies, with price controls and other laws. If all your costs are going up fast and the price you can sell at is fixed by law, your company will be in trouble. Many companies will go under.

Rental properties are particularly bad during hyperinflation. The government rent controls keep rents fixed. At the same time the costs for running the property are going up fast. People view the landlord as rich and so he gets little sympathy for his problem of costs going up faster than income. It is not good to be a landlord during hyperinflation and rental properties can sell for crazy low real prices.

If it is just one country, then selling everything you own in that country and investing in another country is a good strategy, like leaving. However, it may not be limited to one country this time.

If you can borrow at a really low fixed interest rate for a long period and buy some real estate, this could be a good move. After hyperinflation destroys the value of money, you pay off the balance of the debt with worthless money. You need to be sure you can keep the payments up till hyperinflation hits. It does not seem possible to tell exactly when it will hit, so you need to be able to do this for some time.

Gold and silver have held their value for thousands of years and it is a safe bet they will continue to do so.

Backup Transportation

If there is hyperinflation and price controls, you may not be able to buy gas sometimes. A sturdy bicycle with some big baskets could be very handy.Solar Electricity

Utility electricity usually keeps working, most of the time. This time may be worse. Having solar to be able to run a fridge, lights, computers, or charge an electric scooter, electric car, or cellphone, could be very useful.Ocean Going Solar Home

If I had the money, I would make a solar/electric ocean safe house. With a watermaker and food storage you could be fine for a long time no matter what happened anywhere.Tuesday, June 2, 2015

Partner for writing a book on Hyperinflation

On this blog I have a bunch of posts that could be made into an interesting book on hyperinflation.

Some of the key ones are:

- Positive Feedback Theory of Hyperinflation

- CMMT - Cate's Modern Monetary Theory

- Hyperinflation Explained Many Different Ways

- How We Know High Inflation is Coming

- Stages of Hyperinflation

- How to Prepare for Hyperinflation

- parts of Krugman's Missing Model

- combined with Simulating Hyperinflation

- Hyperinflation FAQ

If I could find a partner to turn this content into a book, I expect it could make some money for both of us. I am looking for someone with the following:

- Experience writing a book

- Experience self publishing

- Experience getting book onto Amazon.

- An understanding of Austrian economics.

- Preferably living outside USA

- Willing to work for share of profits or to get paid after book is on Amazon

If you are interested or know someone who might be, please contact me at vincecate@gmail.com.

Friday, May 29, 2015

Artificial Interest Rates, Artificial Wage Rates, and Jobs

Paul Krugman claims not to understand what people mean by "artificially low interest rate". Let me try to explain.

We usually think in terms of supply and demand curves and where they meet is the natural market price. If the government forces some other price, that is an artificial price.

Imagine that the current demand for entry level unskilled labor and supply of such labor meet at $8 per hour. Then imagine government forces the price to $15/hour. Then the supply does not equal demand. At $15/hour the supply of labor exceeds the demand. There will be a shortage of jobs. If the government of Venezuela forces the price of toilette paper below where the supply and demand meet, you get shortages of toilette paper. This is simple micro-economics.

There are people who want to save money and people who want to borrow money. These people make up the supply and demand curves for money. The natural interest rate is the market price where these supply and demand curves meet. If the government artificially sets the interest rate someplace else, bad things can happen. They can force the interest rate down by having the central bank make new money and buy bonds. Driving up the price of bonds lowers the interest rate. The central bank is a government creation and so not really part of a free market. What it does to the interest rate is artificial.

With central banks holding interest rates near 0%, and minimum wages going up, companies have huge artificial incentives to borrow money, buy robots, and replace people. The monthly cost of a loan goes way down if the interest is near 0%. When a company evaluates the choice of robot vs human, they compare the monthly cost of the labor to the monthly cost of the loan. The artificially low interest makes the monthly cost for a robot much cheaper than it naturally would be. Thus the distortion of the interest rates distorts the trade-off between labor and robots in favor of the robots.

It may be easier to think about with some concrete numbers. Imagine the natural market interest rate is 8% but government has forced interest rates so low that companies can borrow at 2%. This would mean the monthly interest paid on a robot loan is 1/4th as much as it would naturally be.

The Keynesian economists theory is that forcing interest rates down mean companies can borrow money, build factories, and make jobs. The reality is the opposite. Low interest rates push companies to replace people with robots.

Forcing minimum wage up and interest rates down is great for robots, but not good for minimum wage earners, who may become unemployed.

On CNN they have an article titled, Robots will replace fast-food workers.

I think a free market would make new jobs as fast as technology made jobs obsolete. I am not a Luddite. But when the government artificially sets the interest rate and artificially sets the labor price, we are not in a free market.

I think a free market would make new jobs as fast as technology made jobs obsolete. I am not a Luddite. But when the government artificially sets the interest rate and artificially sets the labor price, we are not in a free market.

Thursday, April 9, 2015

The Keynesian economist's useless task

Disagreements between different groups of economists often boil down to one group focusing on the short term effects and another group focusing on the long term effects.

The GNP is defined as:

where

Clearly if the government simply takes money from one group and gives it to another it does not increase the size of the economy. So transfer payments are not included in the definition of government spending for calculation of GNP. However, if the government pays some people to dig a ditch and then pays them to fill it back in, the defined GNP goes up. Really this is just another transfer payment that should not be included because there is no real improvement in the economy. Sadly, much of government spending amounts to hidden transfer payments that don't really increase the size of the economy. This is like a loophole in the definition of GNP that makes short term statistics support claims that government spending increases GNP and that austerity hurts GNP.

Keynesians predict that if government spending goes up then the GNP will go up. By the formula defining GNP, and because the other variables are slower to change, the immediate impact of a sudden boost in government spending is a boost in GNP. Predicting this increase is too easy and too useless a task. It is nearly "by definition" and worse, by a loophole in the definition. In this case, it is the short run prediction that is trivial and useless while the long run prediction is interesting, hard, and important.

In the long run, the larger the government is as a percentage of the economy, the slower the economy grows. The government is an overhead that the productive private part of the economy must pay for one way or another. They may pay taxes, or loan it money, or pay an inflation tax. The more economic resources the government controls the less resources are available to grow the real economy.

If you keep applying the Keynesian prescription of more government spending, year after year, the government keeps getting bigger and the real economy suffers. Sadly, today Keynesians are the dominant economists and they have been focusing on the short run for far too long.

"But this long run is a misleading guide to current affairs. In the long run we are all dead. Economists set themselves too easy, too useless a task, if in tempestuous seasons they can only tell us, that when the storm is long past, the ocean is flat again." - John Maynard Keynes

The GNP is defined as:

GNP = C + I + G + X - M

where

C = Private Consumption

I = Private Investments

G = Government Spending

X = Exports

M = Imports

Clearly if the government simply takes money from one group and gives it to another it does not increase the size of the economy. So transfer payments are not included in the definition of government spending for calculation of GNP. However, if the government pays some people to dig a ditch and then pays them to fill it back in, the defined GNP goes up. Really this is just another transfer payment that should not be included because there is no real improvement in the economy. Sadly, much of government spending amounts to hidden transfer payments that don't really increase the size of the economy. This is like a loophole in the definition of GNP that makes short term statistics support claims that government spending increases GNP and that austerity hurts GNP.

Keynesians predict that if government spending goes up then the GNP will go up. By the formula defining GNP, and because the other variables are slower to change, the immediate impact of a sudden boost in government spending is a boost in GNP. Predicting this increase is too easy and too useless a task. It is nearly "by definition" and worse, by a loophole in the definition. In this case, it is the short run prediction that is trivial and useless while the long run prediction is interesting, hard, and important.

In the long run, the larger the government is as a percentage of the economy, the slower the economy grows. The government is an overhead that the productive private part of the economy must pay for one way or another. They may pay taxes, or loan it money, or pay an inflation tax. The more economic resources the government controls the less resources are available to grow the real economy.

If you keep applying the Keynesian prescription of more government spending, year after year, the government keeps getting bigger and the real economy suffers. Sadly, today Keynesians are the dominant economists and they have been focusing on the short run for far too long.

Thursday, February 26, 2015

Gleeful Money Printers

Krugman has written arguments justifying the use of snark. It seems appropriate to address some of his snark and even snark back a bit.

The longer we have gotten away with printing crazy amounts of money without inflation, the more ridiculing and gleeful the money printing enthusiasts have become. They think that because we have gotten away with it for 6 years they have been proven right. This is the kind of thinking that is part of any Ponzie scheme or bubble and so loud now we may be near the peak. They also think that if inflation started the central bank could take steps to immediately stop it.

However, if it takes 6+ years of crazy money printing to start inflation, it is foolish to think the central bank could immediately stop inflation once it starts. Clearly their control is not nearly so precise.

In fact, run-away inflation is a problem a professional economist should know about. High inflation is due to a set of positive feedback loops. For years debt, deficit, and money printing just add to the potential for a chain reaction. Then something triggers the chain reaction and suddenly things flip from normal to high inflation.

I can warn you now that after this happens the money printing enthusiasts will locate the small trigger for the chain reaction and blame the whole thing on that, holding the years of deficit spending and money printing build-up blameless. This is like putting an open bucket of gasoline next to a fire made of pine cones which is sending off sparks and then blaming the random spark for the resulting explosion (another positive feedback loop). The real blame should go to those who setup the potential chain reaction and not the random triggering event.

When they make fun of the idea of sudden inflation by saying, The Spontaneous Combustion Theory of Inflation, they are actually very close to the truth. Just like a fire, hyperinflation is a positive feedback loop. Once started it feeds on itself and gets out of control.

When they say macroeconomic quantum tunnelling or Phantom Phiscal Crisis in attempting to ridicule they are again close to the truth. Ahead of time you don't see the crisis and then things almost jump from normal to high inflation.

They use derogatory terms like inflation cult but won't address the sound arguments for the risk of runaway inflation.

Imagine an expert says that a particular location is due for a big earthquake. Imagine some people ridicule this person for 6 years with things like "Spontaneous Earth Rip Theory" and "Phantom Earth Movement". Then on the 7th year there is a big earthquake. At that point it becomes clear who is right and who is foolish. Earthquakes are also positive feedback loops. After the inflation positive feedback loop hits, it will then become clear who is right and who is foolish.

This past week Ukraine and Venezuela both have had huge drops in the value of their currencies. The high inflation positive feedback loops have clearly kicked in for these countries. Fortunes are being lost and lives are being ruined. Because both governments spend much more than they get in taxes they are forced to keep printing huge amounts of money even as the value of their currency crashes.

Japan is spending nearly twice what they get in taxes and has huge quantities of bonds coming due. After Japan's inflation starts they will not be able to control it there either. When they finally realize that Japan's money printing enthusiast was wrong it will be too late. The theory of high inflation is serious business. It is no laughing matter.

The money printing enthusiasts go on and on about the dangers of a deflationary death spiral even though this never happens in the real world. They see a bit less than 2% inflation and yell "deflation", which is silly. Inflationary death spirals happen all the time with hundreds and thousands of percents but the money printing enthusiasts can't seem to comprehend these.

The money printing enthusiasts would have you just look at the "no inflation so far" result for 4 currencies (Japan, UK, USA, Eruo) for the last 6 years to "prove" their case. They would have you ignore hundreds of years of experience from more than 100 countries. You can look at Ukraine, Venezuela, and Argentina right now or China a thousand years ago or hundreds of other examples where lots of money printing resulted in lots of inflation. Extrapolating from 4 cherry picked bits of data and ignoring all the rest of the data is not science, it is foolish.

Krugman keeps incorrectly saying that the fear of inflation side does not have an economic model of how debt and deficit cause things to go bad for a country that prints its own money even though for years I have pointed him to an excellent model.

A commenter on Krugman's blog said that "money printing enthusiasts" is not a fair name for Krugman's side of the debate. Krugman makes up all kinds of unfair names for our side of the debate, so even an unfair name for him would only be fair. :-) However, it really is a very accurate name for his position. Kruman posts about economics, politics, and music. More than half of his economics posts are either ridiculing those who are worried about inflation or making a case for "stimulus" which is just code for printing money. So his economics position mostly boils down to advocating money printing and attacking anyone worried about money printing. He really is a "money printing enthusiast".

Here is an intellectual challenge from the "fear of inflation" side for the "money printing enthusiasts". Can you find a theoretical explanation that fits a high percentage of cases of runaway inflation (explaining why it is "out of control") which does not make Krugmans advice to Japan seem irresponsible? If you come up with something like war, or shock to tax base, or corrupt government, that is just one of many reasons for a government budget deficit to get out of control, note that it will not cover nearly as high a percentage of cases as if you just say "deficit out of control".

The longer we have gotten away with printing crazy amounts of money without inflation, the more ridiculing and gleeful the money printing enthusiasts have become. They think that because we have gotten away with it for 6 years they have been proven right. This is the kind of thinking that is part of any Ponzie scheme or bubble and so loud now we may be near the peak. They also think that if inflation started the central bank could take steps to immediately stop it.

However, if it takes 6+ years of crazy money printing to start inflation, it is foolish to think the central bank could immediately stop inflation once it starts. Clearly their control is not nearly so precise.

In fact, run-away inflation is a problem a professional economist should know about. High inflation is due to a set of positive feedback loops. For years debt, deficit, and money printing just add to the potential for a chain reaction. Then something triggers the chain reaction and suddenly things flip from normal to high inflation.

I can warn you now that after this happens the money printing enthusiasts will locate the small trigger for the chain reaction and blame the whole thing on that, holding the years of deficit spending and money printing build-up blameless. This is like putting an open bucket of gasoline next to a fire made of pine cones which is sending off sparks and then blaming the random spark for the resulting explosion (another positive feedback loop). The real blame should go to those who setup the potential chain reaction and not the random triggering event.

When they make fun of the idea of sudden inflation by saying, The Spontaneous Combustion Theory of Inflation, they are actually very close to the truth. Just like a fire, hyperinflation is a positive feedback loop. Once started it feeds on itself and gets out of control.

When they say macroeconomic quantum tunnelling or Phantom Phiscal Crisis in attempting to ridicule they are again close to the truth. Ahead of time you don't see the crisis and then things almost jump from normal to high inflation.

They use derogatory terms like inflation cult but won't address the sound arguments for the risk of runaway inflation.

Imagine an expert says that a particular location is due for a big earthquake. Imagine some people ridicule this person for 6 years with things like "Spontaneous Earth Rip Theory" and "Phantom Earth Movement". Then on the 7th year there is a big earthquake. At that point it becomes clear who is right and who is foolish. Earthquakes are also positive feedback loops. After the inflation positive feedback loop hits, it will then become clear who is right and who is foolish.

This past week Ukraine and Venezuela both have had huge drops in the value of their currencies. The high inflation positive feedback loops have clearly kicked in for these countries. Fortunes are being lost and lives are being ruined. Because both governments spend much more than they get in taxes they are forced to keep printing huge amounts of money even as the value of their currency crashes.

Japan is spending nearly twice what they get in taxes and has huge quantities of bonds coming due. After Japan's inflation starts they will not be able to control it there either. When they finally realize that Japan's money printing enthusiast was wrong it will be too late. The theory of high inflation is serious business. It is no laughing matter.

The money printing enthusiasts go on and on about the dangers of a deflationary death spiral even though this never happens in the real world. They see a bit less than 2% inflation and yell "deflation", which is silly. Inflationary death spirals happen all the time with hundreds and thousands of percents but the money printing enthusiasts can't seem to comprehend these.

The money printing enthusiasts would have you just look at the "no inflation so far" result for 4 currencies (Japan, UK, USA, Eruo) for the last 6 years to "prove" their case. They would have you ignore hundreds of years of experience from more than 100 countries. You can look at Ukraine, Venezuela, and Argentina right now or China a thousand years ago or hundreds of other examples where lots of money printing resulted in lots of inflation. Extrapolating from 4 cherry picked bits of data and ignoring all the rest of the data is not science, it is foolish.

Krugman keeps incorrectly saying that the fear of inflation side does not have an economic model of how debt and deficit cause things to go bad for a country that prints its own money even though for years I have pointed him to an excellent model.

The Phillips Curve theory was from data

under a gold standard. If there is full employment under a gold

standard then wage prices will be higher. It is a simple supply and

demand observation. Taking this data and thinking that if you print

more money so wages go up you will get full employment is either stupid or dishonorable. Using data from a period with no inflation to justify inflation is wrong. Really what is going on when they print more money, as

explained on page 6 of Keynes book, is that you are tricking people into

working for a lower real salary which makes it easier to get full

employment. But if you talk about it this way it does not sound like

you are trying to help the common man when you advocate money printing.

So the Phillips Curve makes a better sounding cover story.

Here is an intellectual challenge from the "fear of inflation" side for the "money printing enthusiasts". Can you find a theoretical explanation that fits a high percentage of cases of runaway inflation (explaining why it is "out of control") which does not make Krugmans advice to Japan seem irresponsible? If you come up with something like war, or shock to tax base, or corrupt government, that is just one of many reasons for a government budget deficit to get out of control, note that it will not cover nearly as high a percentage of cases as if you just say "deficit out of control".

Monday, February 16, 2015

Rush out of JGBs starting?

Over the last month JGB rates and prices have been on the move:

In the last month the yield on 10 year bonds has doubled from 0.22% to 0.44%. This means half the interest earned over the next 10 years just covers the drop in bond price over the last month.

The 5 year has gone from 0% to 0.13%. This means that all the interest earned over the next 5 years just equals the drop in bond price over the last month. Whatever the yield is next month for 5 years will still just equal the drop since January. Risk reward balance is not good and does not improve even as yields go up.

The Bank of Japan is buying bonds really fast. If the yield is going up and bond prices are going down then the selling must be even stronger.

I am expecting a panic out of JGBs and wonder if it is starting. I am interested to see the next 10 day report on Bank of Japan assets. The last two 10 day periods they increased base money by 3% and 0.6%. Those are not annual rates. That 3% in increase in 10 days looks crazy, and it is. Will also be interesting to keep watching the JGB yields.

With them printing so fast, who would want to hold JGBs at what are still crazy low rates? But if everyone is getting out of JGBs, then they will have to print faster. These two things can result in a death spiral. Really seems like it is not a good time to be holding either JGBs or Yen.

Subscribe to:

Posts (Atom)